Consumer Purchase Intentions for Holiday 2022: Key Highlights from the NPD Report

The NPD Group is an American market research company that’s focused on eCommerce and retail. It sources data from both retailers and consumers to figure out how consumers shop across channels.

NPD helps retailers, manufacturers, and analysts predict future performance, identify consumer trends and market opportunities, and improve marketing and product development.

As we are in the midst of the holiday season 2022, the NPD group recently launched their annual report titled ‘Now in Retail: 2022 U.S. Holiday Purchase Intentions‘.

This report talked about –

- How do consumers expect to spend this season?

- How the economic concerns may affect their decisions?

- How do they plan to shop during the holidays?

So, in this article, we are going to share with you the top highlights from the NPD report to help you get an understanding of customer purchase behavior during the holiday season so you can strategize accordingly.

Let’s get started.

Holiday retail outlook for 2022

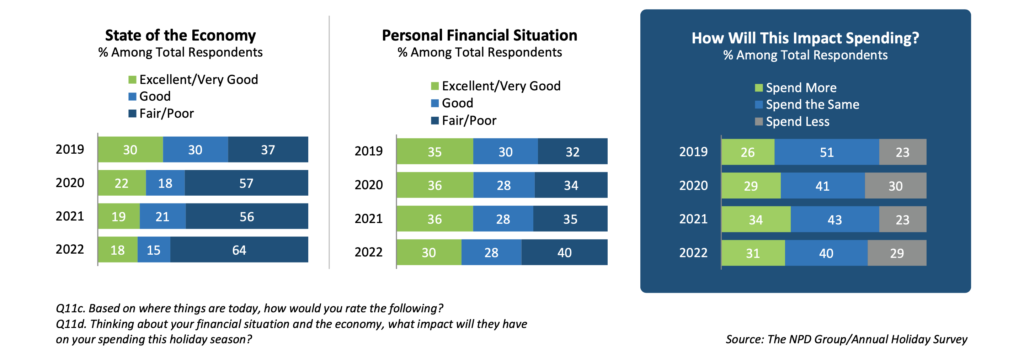

As per the NPD report, consumers will seek a balance between holiday celebrations and financial caution during the holiday season.

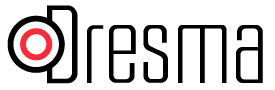

Due to increased negativity around the economy and reduced personal finances, 29% of US consumers would spend less during this holiday season. This is an increase over last year even though the majority of shoppers plan to spend the same or more than last year.

In 2022, we can expect holiday sales to reach last year’s levels but there will be a large emphasis on in-store shopping.

As per Marshal Cohen, the chief retail advisor for NPD –

“Consumers are ready to get out and celebrate over the 2022 holiday season, but last year’s optimism has taken a beating as financial concerns have them feeling a bit more grinchy this year.

Despite economic challenges, consumers still have just as many friends and family members to shop for during the holidays, they will just be spending differently.”

Here are a few other key points that the NPD report highlighted –

Financial caution will come to the forefront, influencing many other decisions:

- The overall consumer spending is expected to be less than last year.

- More consumers have a negative perception of the economy and personal finances. This is the lowest seen in recent years.

- There will be limited opportunities around impulse spending as fewer consumers plan to self-gift during holiday shopping.

- More consumers will hold off on purchasing gifts until they can see family/friends in person.

Consumers will spend more than they did in 2020, signaling a hopeful holiday season for retail:

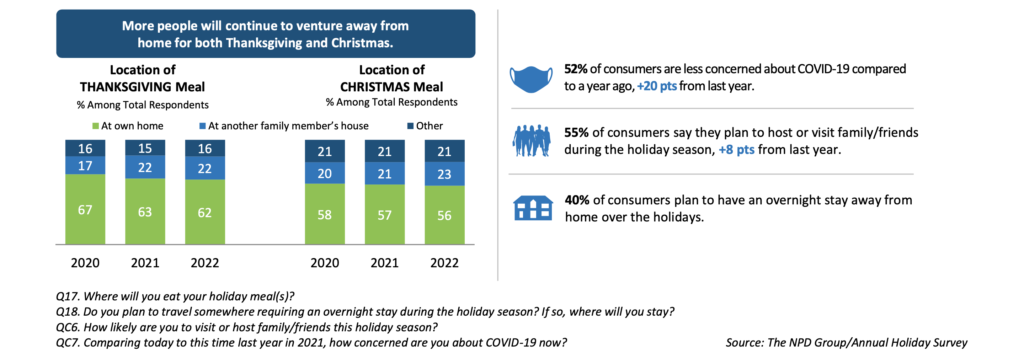

- Consumers are less concerned about Covid-19.

- More people will celebrate with their family and friends. 40% of consumers plan to travel during the holidays.

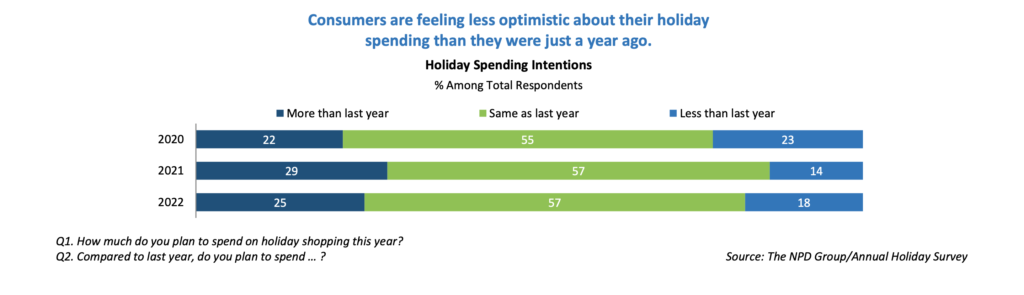

- There will be increased purchase intent for clothing, fashion, jewelry, and electronic items, indicating a more personal shopping attitude for the holidays.

- Consumers are less likely to give experiences as gifts this year.

The holiday season will be defined by changes to where, when, and how consumers shop:

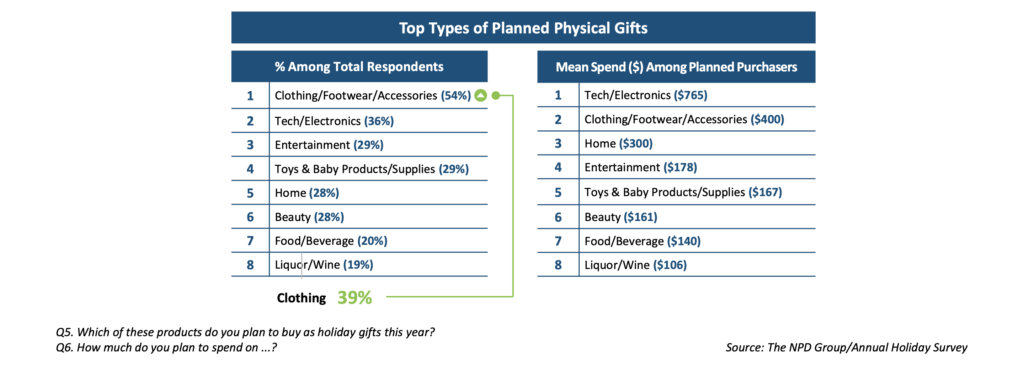

- Shoppers will start their holiday shopping earlier, spreading out their spending.

- Consumers plan to do more shopping in physical stores as compared to online shopping.

- Compared to last year, mass merchants witnessed the biggest growth.

- We will see the first major decline in anticipated online holiday shoppers and an even greater drop in those planning to shop from online-only stores.

- Fewer consumers perceive Cyber Monday as the time for the best deals.

The US retail sales will start normalizing:

- Consumers will continue demonstrating a willingness to spend. Despite the rising prices, US consumers will continue to spend on general merchandise products. Retail sales in 2022 were 17% above pre-pandemic levels in 2019.

- Consumers are maintaining elevated spending while getting fewer products. Unit sales declined by 8% compared to last year but the consumers’ appetite for products appears to be normalizing.

- Retail spending has become more stable. As 2022 progressed, there was a stretching of traditional retail shopping periods and a flattening of typical sales peaks. There is a careful prioritization of spending with a clear focus on needs.

What will consumer spending look like?

Hesitancy among consumers

Since consumers are hesitant to spend this holiday season, on average they plan to spend $760 on holiday shopping this year. This is higher than in 2020 ($691) but below the spending in 2021 ($785).

Consumer spending and intent

For most key categories, consumer spending and intent are down since cautious consumers plan to spend less. However, for some categories, there is an increase in average planned spending.

Effect of consumer hesitancy on experiences

As per the NPD report, fewer consumers plan to spend money on experiences during this holiday season.

Consumer shopping plans for the holiday season

Holiday shopping to begin early

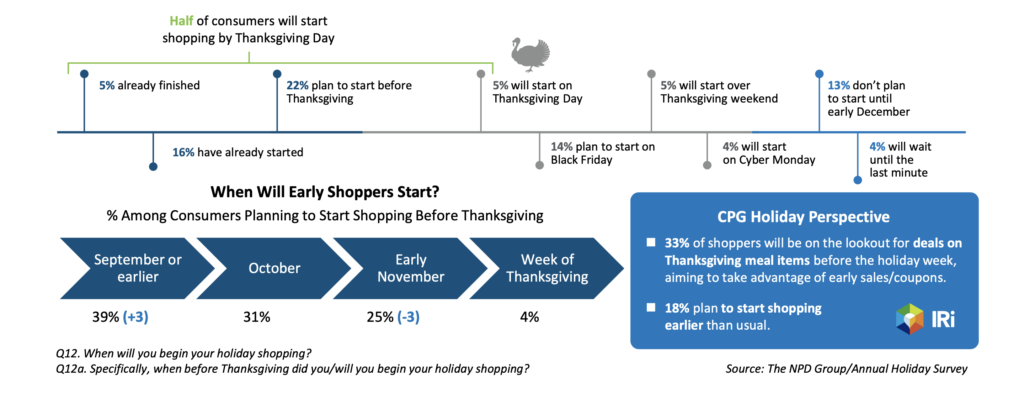

The majority of consumers will begin their shopping earlier than Thanksgiving.

Shopping to begin by Thanksgiving weekend

When compared to 2021, early shoppers will begin shopping even earlier.

Black Friday and Prime Day as the biggest shopping days

Black Friday is closely followed by pre-November dates like Prime Day as being the biggest shopping day of the year.

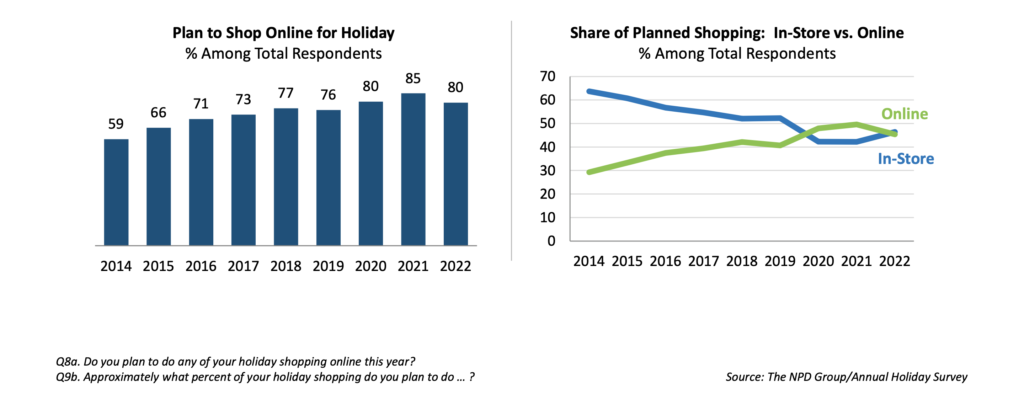

First major decline in online sales

During this holiday season, online sales will see their first major decline as per the NPD report.

Customer perception and media

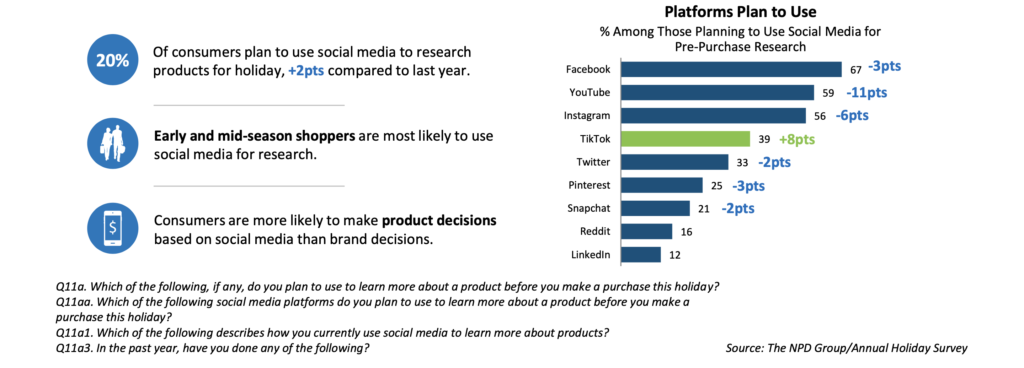

Social media will continue influencing shoppers

Social platforms like Facebook, TikTok, and Instagram will keep playing an increasingly important role in helping consumers research products. TikTok, in particular, has seen impressive growth and has stolen share from legacy players in the space.

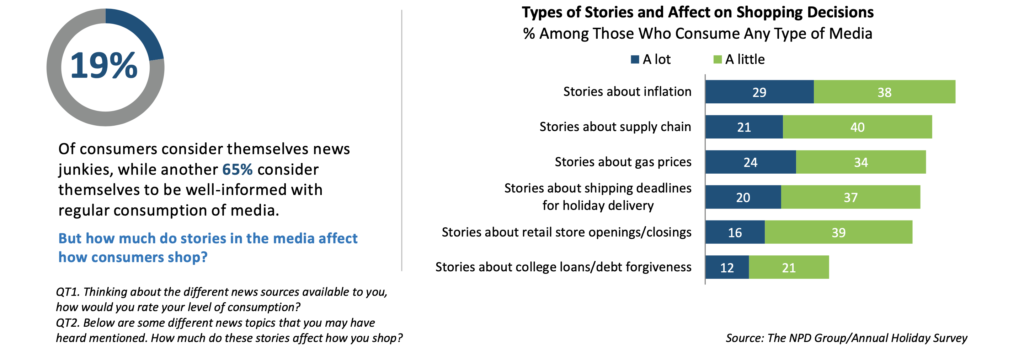

Media has a part to play

Most consumers are relying on some type of media for making a shopping decision, either watching, reading, or listening to stories.

Financial worries will weigh consumers down

The NPD report highlights that the current customer perception towards the economy as well as their own financial situation is below the levels seen in 2020.

Celebrations to continue despite the uncertain spending

Consumers have no plans to halt celebrations even if their spending is low. The majority of survey respondents said that they plan to travel and see more family and friends this year as pandemic-related concerns wane.

Wrapping up

The NPD report makes it clear that the economic uncertainty and the current geopolitical situation will have an impact on consumer shopping behavior.

While shoppers will be cautious during the holiday season, retailers need not fret as holiday spending is expected to still be significantly higher than in 2020.

Moreover, there will be many categories that will witness an increase in average planned spending.

As per Marshal Cohen –

“Navigating this year’s shopping dynamics will require patience and persistence with the consumer, and a perspective on the holiday season that extends beyond the traditional retail definition.”

So, those brands will be successful who put an effort to stand out from the competitors.

If that’s something you need help with, feel free to reach out and connect with us. Dresma offers product-visual-related solutions that help brands stand out and scale up.

To know more about how we can help you, feel free to get in touch with us.

If you liked reading this article, we suggest checking out these as well –